"I understand that many find Trump terribly unsympathetic, but we will survive this"

People in Norway will have to wait even longer for cheaper mortgages. Vacations will be more expensive. But Trump's threats of tariffs will not have as much impact as many fear, professor believes.

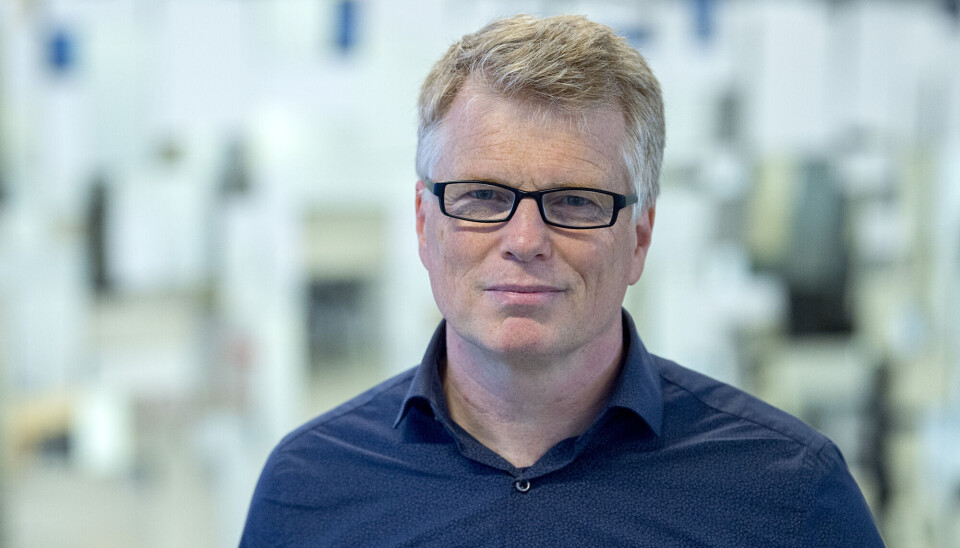

For many Norwegians, it was incomprehensible and perhaps frightening that Donald Trump won the presidential election in the USA. But Professor Ola Honningdal Grytten at the Norwegian School of Economics aims to tone down the catastrophic thinking.

"There were many catastrophic scenarios when he took office in 2017 as well, but we didn't go bankrupt. Norway came through Trump's previous term relatively unscathed economically," he says.

Imported goods and vacations will be more expensive

Trump in the White House places greater pressure on the Norwegian and European economy, chief economist Elisabeth Holvik at Sparebank 1 tells E24 (link in Norwegian).

Already on election night, the Norwegian krone weakened in value against the dollar as the dollar strengthened.

"This leads to us importing inflation, because what we buy from abroad becomes more expensive. Norwegian companies that import input goods for their products from abroad must also pay more. Inflation in Norway will persist," says Grytten.

Input goods include things like animal feed, fertilisers, medicines, and machinery. Inflation means that things become more expensive, making money worth less.

Most Norwegians will notice this as higher prices on goods and services, especially for items imported from abroad.

If the Norwegian krone weakens even further, vacations abroad will also become more expensive for Norwegians.

Longer wait for cheaper mortgages

"A weaker krone and increased inflation also mean that it will take longer before Norges Bank can lower interest rates," says Grytten.

Experts disagree on whether this will result in fewer interest rate cuts next year than expected, and whether the first rate cut will come in the spring or not until summer.

The continued high interest rate can be an advantage for young people who have not yet bought a home. It can keep housing price growth in check.

"This is both an advantage and a disadvantage as the cost of loans will be higher," says Grytten.

The Oil Fund profits from a weak krone

But a weak krone is not all bad news for Norway. Companies that sell goods abroad and are paid in dollars will benefit from it.

"Especially since we sell a lot of oil and gas, this is positive news for the Norwegian economy," emphasises Grytten.

The Oil Fund will also profit from this, as the money is placed in foreign currency, which is now worth more compared to Norwegian kroner.

Risk of increased tariffs and trade war

The dollar strengthened on election night, and the American stock market rose the next day. Trump has credibility in the monetary and stock markets, and confidence in the American economy has increased.

One reason is that Trump has announced that he will drastically raise tariffs on foreign goods. Trump has promised 60 per cent tariffs on Chinese goods and 10 to 20 per cent higher tariffs on almost all imported goods from other countries.

Trump wants to do this to make it more profitable to produce goods in the USA.

A small, open economy like Norway's will be severely affected by increasing trade conflicts, Elisabeth Holvik at Sparebank 1 tells E24. Grytten is not quite so pessimistic.

"It will impact Norway, but I don't think this will be as significant as many fear," he says.

Grytten is fairly certain that Norway will face a very different tariff policy than China.

"In Trump's previous term, it was China that bore the brunt of increased tariffs more than anyone. Most likely, the EU and Norway will be spared from a major increase in tariffs. It will also be in the USA's interest, as the EU and the USA have a lot of trade," he says.

But Trump is unpredictable and can implement measures on a whim, to put it bluntly, he adds.

Trade with the EU is much more important

If Norway faces higher tariffs, it will also contribute to longer-lasting price increases.

"Biden continued and even increased the tariffs that Trump implemented in his first term," Grytten points out. But this received little attention in European media.

Increased tariffs from the USA will, in any case, have limited significance for the Norwegian economy, Grytten notes.

"Norwegian trade with the USA is negligible compared to our trade with the EU. If Sweden, Denmark, the UK, or Germany reduced trade with Norway, it would be far more dramatic," he says.

High spending in Norway is a bigger problem

When Trump was last in office, he spent a lot of government funds. He will likely spend a lot now as well. This will drive up prices and require the USA to keep interest rates high. The national debt of the USA is at a record high.

This, in turn, will help keep interest rates high in Norway as well.

But Harris was also likely to have supported significant public spending and deficits in government finances.

"For us, it's primarily the already high public spending in Norway that is driving inflation, and it's a much bigger problem for Norway than what is happening in the USA. We're currently spending far too much money here at home," says Grytten.

"I understand that many find Trump terribly unsympathetic, but we will survive this," he adds.

Norwegian businesses are holding their breath

The Confederation of Norwegian Enterprise (NHO) believes that the unpredictability is negative in itself. They fear that a resurgence of a trade conflict between the EU and the USA would pose a significant risk to Norwegian businesses.

This is because the EU market is crucial for Norwegian companies, CEO Ole Erik Almlid of NHO wrote in an article in Dagens Næringsliv (link in Norwegian).

The European Commission has set up a dedicated Trump task force. The plan is to establish new agreements with the USA to ensure that EU businesses receive special treatment.

Norway is not part of this because we are not involved in the EU's trade policy.

Norwegian companies, therefore, would not be included if the EU and the USA reached new agreements, Almlid of NHO wrote in Dagens Næringsliv.

———

Translated by Alette Bjordal Gjellesvik

Read the Norwegian version of this article on forskning.no

Related content:

Subscribe to our newsletter

The latest news from Science Norway, sent twice a week and completely free.