Is it worth pursuing employment if you can live off social security benefits?

Researchers have examined the finances of people in Norway who receive almost all of their income from the welfare state.

The researchers behind the new study investigated about 90,000 households. The majority of them were single individuals.

In 2017, these people received almost all of their income from social security programmes.

When some individuals in these households found work the following year – in 2018 – 30 per cent of them experienced a reduction in income or had the same amount of money as when they were living on state or municipal support schemes.

Income decreased

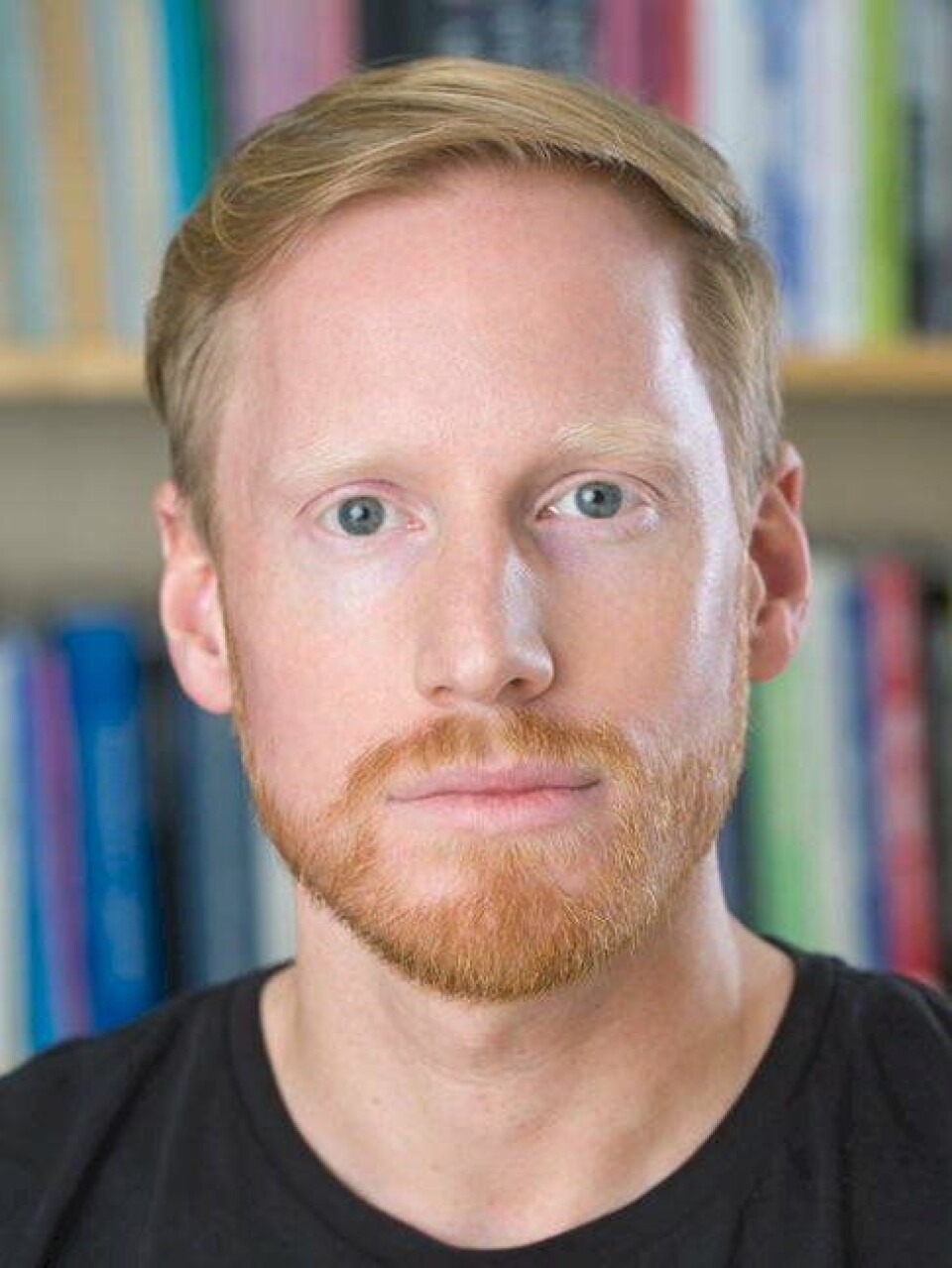

“The overall picture we’re left with is that some people found that their family income decreased even though they started working more,” Kristian Heggebø tells sciencenorway.no. He is a researcher at the Norwegian Social Research Institute (NOVA).

This was primarily because increased income from work was not able to compensate for the financial loss of social welfare or other benefits.

A typical situation for people who started working was that they had reached the maximum duration of their unemployment benefits, sickness benefits, or work assessment allowance. The lack of further support from the state basically forced them into work.

Working has to be financially rewarding

‘Working has to be financially rewarding’ has been a mantra among Norwegian politicians for several years – both on the political right and left.

Nevertheless, some politicians are concerned that the benefits from the Norwegian welfare state are so good that for a significant number of social security recipients, it doesn’t pay to work. Several cases in the media have reinforced this scepticism, such as in this article in Nettavisen (link in Norwegian).

Researchers Kristian Heggebø, Jon Ivar Elstad, and Axel West Pedersen at the research institute NOVA at OsloMet University have now calculated this.

Serious health problems

“The participants we selected received almost all of their income from social security schemes in 2017,” Heggebø says.

He reminds us that this is a rather special group of people. Many probably have serious health problems.

The NOVA researcher also points out that many employers tend to be sceptical of this group, precisely because of their health problems.

If they get a job, it is usually for a small part-time position. It is often a short-term job as well, and is quite often poorly paid.

The researchers believe this information could help explain why so many people end up earning less money at work compared to when they were living off social security benefits.

Low income from work

At the same time, the researchers found that a majority of the study participants – around 70 per cent – earned more in total family income when they were employed.

However, this increase in income was usually small.

In half of the cases where someone started working and the total income increased, the increase was less than 50,000 NOK (about 4,470 USD) more per year.

The researchers point out that many of the 90,000 households are low-income households.

Almost half of the families the researchers found for this study are considered poor, when poverty is defined as income lower than 60 per cent of the median income in Norwegian society.

“Almost two out of three of households whose family income didn’t improve after increasing their work participation were considered poor,” Heggebø says.

21,280 USD a year

The average disposable income in 2017 for the 90,000 households was NOK 238,000 (21,280 USD).

That same year, the threshold for a single person to be defined as low-income or poor was NOK 227,500 (20,340 USD).

By comparison, the average annual salary for low-wage occupations such as cleaners and auxilliary workers in 2017 was about NOK 380,000 (33.970 USD).

Most viewed

Single-person households dominate

The vast majority of the households or ‘families’ studied by the researchers consisted of just one person.

About 17 per cent were families with a single parent. Only 11 per cent were families where two adults lived together.

In 14 per cent of the cases, the oldest person was an immigrant from Africa or the Middle East. Such families accounted for 43 per cent of the families that mainly lived on social security benefits, but only made up 5 per cent of the families who mainly lived on disability benefits.

Why such an abrupt stop in support?

The NOVA researcher wonders why there is such a sudden halt in the economic assistance people receive, for example when work assessment allowances stop after three years.

A consequence of this policy is that quite a few social security recipients find that their family income stagnates or falls, according to Heggebø.

This happens even if they get a job.

Heggebø suggests the possibility of a scaled benefit system instead.

He envisions welfare recipients gradually receiving less financial help as their connection to the labour market becomes stronger.

“And then we have the strangest scheme, sosialhjelpen (social help), which is supposed to be temporary financial assistance based on need that the municipalities have to cover. However, quite a few people receive this assistance for a long time,” Heggebø says.

“Among these long-term recipients we often find people with serious health problems, many times in combination with substance use. They’re carrying heavy baggage,” he says.

Eternally recurring debate

The NOVA researcher characterises the debate about social security and work – whether it really pays for people receiving benefits to work – as an ‘eternally recurring’ one in Norwegian politics.

Political decisions have also resulted from the debate.

“For example, the work assessment allowance was reduced considerably for younger recipients, because the authorities – referring to the Employment Committee – believed that younger recipients would be less motivated to look for a job if the benefits were too ‘generous’,” Heggebø says.

How much money people receive

“You’re usually entitled to 66 per cent of your previous annual income, with an upper limit of 6G, or six times the average of the Norwegian National Insurance scheme basic amount. That means a maximum of NOK 470,000 (42,190 USD) for people with medium to high incomes,” Heggebø says.

“For people with no previous connection to the labour market, the minimum benefit is 2G and far lower. Today, this corresponds to NOK 237,240 (21,300 USD) annually.”

“But for those under the age of 25, the minimum benefit is only 2/3 of 2G, or less than NOK 160,000 (14,360 USD) annually according to today's basic amount.”

Heggebø believes that this policy can lead to a life of poverty, which in turn can contribute to worsening people’s health situations.

Confusingly many schemes

Heggebø points out that Norway has a bewildering number of schemes that help ensure an income for the poor.

The researchers found at least 14 different social security schemes in their study of the 90,000 families that would provide financial support to low-income households.

“We might want to consider an alternative reality with slightly fewer and more transparent benefits,” he suggests.

Heggebø recognises that there are certainly good historical reasons why Norway has ended up with such a fragmented system of distributing social security benefits.

“But from the point of view of the individual family and those receiving benefits, the current system can be unnecessarily complicated,” he says.

———

Translated by Ingrid P. Nuse

Read the Norwegian version of this article at forskning.no

Reference:

Elstad et al. Lønner det seg å jobbe? Inntektsutvikling blant stønadsmottakere som øker sin arbeidsdeltakelse (Is it worth working? Income development among benefit recipients who increase their work participation), Søkelys på arbeidslivet, vol. 40, 2023. DOI: 10.18261/spa.40.2.3