We accept tax evasions more during times of crisis - for low-income earners

Only two per cent of Norwegians accept that others evade taxes. But during the Covid pandemic, we had a greater understanding of low-income earners evading taxes to compensate for lost income.

The level of punishment for tax evasion and the risk of being discovered affects whether we follow our government’s tax rules, previous research shows.

Our environment also affects us. Attitudes to dishonest commuter travel deductions change, for example, when employees change work environments to one where there is more evasion, a previous study shows.

But how do economic crises affect our willingness to pay taxes?

The Norwegian Tax Administration's (Skatteetaten) behavioural team wanted to find out.

Mapping our attitudes

Skatteetaten’s team maps what affects taxpayers' ability and willingness to follow tax rules.

The team has done several studies to find out more about Norwegian's tax morale.

The team is interdisciplinary and consists of economists, psychologists and behavioural scientists. The purpose is to find out how the agency can help everyone pay the right tax.

“It is important for us to be able to finance the welfare state,” behavioural scientist Ivana Haakens tells sciencenorway.no.

The vast majority do not accept tax evasion

In Norway, tax morale is high compared to many other countries.

But when the Covid pandemic hit Norway, Skatteetaten wanted to investigate how the crisis impacted our tax morale.

Would more people think it was okay for others to work illegally or make deductions they were not entitled to?

Many low-income individuals work in service professions with close customer contact. They are unable to work from home, unlike high-income earners who often can.

The agency wanted to map whether we have an easier time accepting that low-income earners evade taxes.

Unemployment

A digital questionnaire was sent to a selection of participants.

Everyone first received the same information: "Unemployment in Norway has risen sharply in connection with the Covid crisis."

The tax authorities wanted to see if viewpoints differed in the group that received additional information about who was most affected by unemployment.

But there were no significant differences.

More accepting that low-income individuals evade taxes

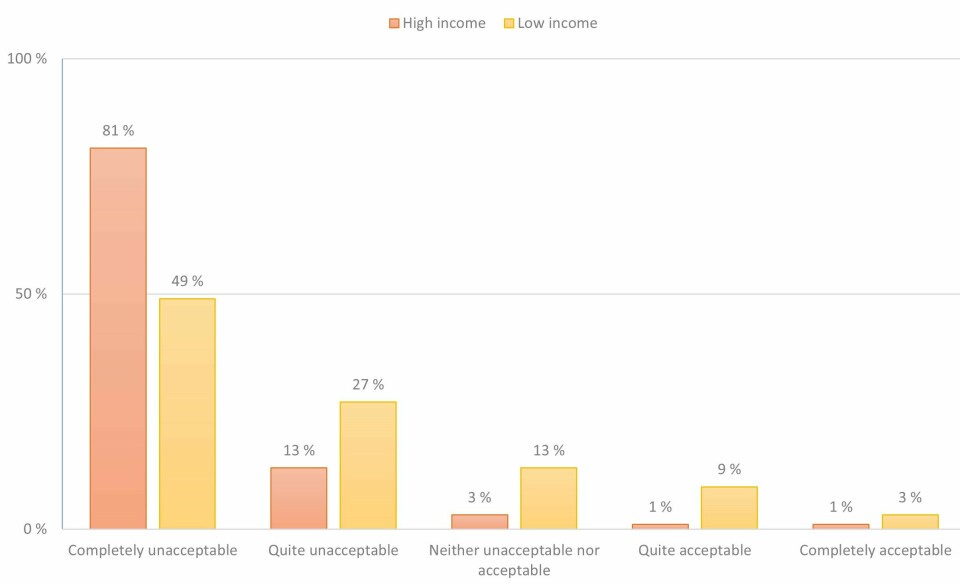

But there was a big difference in what we accept, depending on the 'tax-evader's' income.

Far more participants answered that they have a higher acceptance when low-income people cheat on their taxes compared to when high-income earners do so.

Nevertheless, the vast majority - three out of four - thought that it was completely or quite unacceptable also for people with low incomes to evade taxes.

Only 12 per cent thought it was completely or quite acceptable.

High-income earners should not cheat

Participants were much less understanding of high-income earners evading taxes compared to low-income earners.

As many as 95 per cent thought it was completely or quite unacceptable for people with high incomes to evade taxes.

Of these, 81 per cent thought it was completely unacceptable that high-income earners evaded taxes illegally.

While only 49 per cent thought the same about people with low incomes.

“The survey captures more general attitudes in the population, and the results indicate that there is greater acceptance that those with low incomes evade taxes, regardless of what economic situation the country is in,” Haakens says.

One possible explanation may be that they think the Norwegian tax system is unfair. But the survey does not actually cover this, she emphasises.

We pay little tax in Norway

We pay less tax in Norway than in many other countries. This is measured in relation to the gross domestic product.

Income tax is also low in Norway. Under the previous conservative government, income tax was reduced on several occasions.

“We do not have as high taxes in Norway as some like to present it as,” Vidar Christiansen, professor emeritus at the Department of Economics at the University of Oslo (UiO) told forskning.no in 2018 (link in Norwegian).

Tax fraud to save jobs is ok-ish

Participants were also asked about their thoughts on companies evading taxes, depending on whether the company is in a crisis situation or not.

In general, the participants' own acceptance that companies evade taxes is low. Only two per cent state that it is acceptable in normal times.

“When evasion comes as a result of shocks in the economy, our acceptance increases dramatically,” says Haakens.

People think it becomes more acceptable if the reason for the tax fraud is customer failure, to save jobs, or to avoid bankruptcy.

The investigative team does not know whether these attitudes are due to crisis response measures.

“But the finding can help identify risk situations, and it emphasises the value of early intervention to avoid lasting, negative changes in attitudes to tax evasion,” says Haakens.

Think others have poorer tax morale

Participants were divided into two groups, where one had to state what they themselves believe and the other what they think the rest of the population thinks.

Far more people believe that others accept that companies evade taxes, than those who actually accept it.

In normal economic times, only two per cent state that they themselves think it is acceptable for companies to evade taxes. While as many as 17 per cent believe that others accept it.

About 13 per cent think it is acceptable if the company does it to save jobs or avoid bankruptcy.

More than twice as many, 34 per cent, believe others accept that companies evade taxes in order to save jobs or avoid bankruptcy.

“A possible danger in that many believe there is greater acceptance of tax evasion than there actually is, is that your own attitudes can change at the expense of what you think of others,” Haakens says.

In that case, it is important to communicate how unacceptable people actually think tax evasion is, she says.

———

Translated by Alette Bjordal Gjellesvik.

Read the Norwegian version of this article on forskning.no

Source:

S. Skaalbones and I. Haakens Holdningene til skatteunndragelse påvirkes av krisetid og hvem som unndrar (link in Norwegian) (Attitudes towards tax evasion are influenced by times of crisis and who evades). Analysis, The Norwegian Tax Administration, 2021.

------