Insurance is a foundation of modern society

When modern insurance arrived in the 18th century, houses and buildings suddenly became collateral for loans. This laid a foundation for modern society, says economics professor Knut Sogner.

“Insurance is based on a calculated risk, which makes it possible to calculate an insurance premium, so that you don't end up too badly when things go wrong,” says Knut Sogner, a professor of economic history at the Department of Law and Governance at BI Norwegian Business School in Oslo.

But let's go back to the beginning:

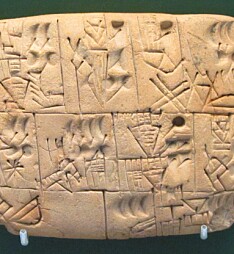

At least eight large double gates led into the famous ancient city of Babylon, south of Baghdad in present-day Iraq.

When the caravans drove through the gates in the 6th century BC, the investors in the trading house Murashu could finally relax.

They had assumed the risk for the caravan, by providing loans for the uncertain journey at high interest rates. The costs of the loan entailed the distribution of risk, and the loan could be repaid if the caravan reached its destination.

The insurance principles were transferred to ships and goods.

Three hundred years later, residents of Milo in Asia Minor could pay money into the town treasury against interest. Thus, a family was paid a lump sum when the policyholder died. Life insurance was thus established.

From calculation to speculation

Modern insurance is based on calculated risks. The first example of a mortality table with some scientific calculation is from the year 220 and the Roman jurist Ulpian. A mortality table is a mathematical way of calculating, for example, life expectancy.

Throughout the centuries that followed, many different associations were created, where people were obliged to help each other in the event of fire, theft and death. Often these were benefits in kind, such as people helping you to rebuild a house if yours burned down.

Sogner identifies a shift in the importance of insurance in northern Europe during the 18th century. New companies offered fire insurance, and subsequently companies offered life insurance and insurance of valuable goods. The insurance companies thus provided a community service for both individuals and other companies.

“Uncertainty cannot be calculated, but risk is about mathematics. Mortality and fires can be predicted based on historic knowledge. In our times, some accidents like landslides have become more frequent, which illustrates how risk must be calculated in order to set the cost, the premium, on insurance,” Sogner said.

As someone who studies recent economic history, Sogner finds it fascinating to see how the institution of insurance is an integral part of the rise of modern society. He cites the insurance company Norges Brannkasse established in 1776 as an example.

“Norges Brannkasse was established after big city fires. Today, everyone has damage insurance on their home. The interesting thing is that you could thus plan your own future to a greater extent. You suddenly had some assurance that you would retain your overall worth even if your house burned down,” Sogner said.

Mortgage on real estate

As a result, people could take a mortgage on real estate, go to the bank and take out a loan with the security in the mortgage. The property was insured, and this insurance thus formed a basis for modern society, Sogner said.

“Material society is based on insurance, which has provided a basis for modern growth. Those who take the mortgage are safe with an insured property. You can then establish long-term loans, which form the basis for the entire process of capital accumulation.”

The same applied to ships and eventually machines. Sogner points out that insurance on goods for businesses came in the 1840s. When machines made their entrance in the Industrial Revolution, they became more expensive than the buildings.

"Insurance offered the opportunity to create a welfare society, and the faith in that is linked to the protection of the values, the insurance,” Sogner said.

Something to think about for tenants

Thus owning one's own home, which can be mortgaged, and forms the basis for one's own welfare and thus also secures one's wealth, is perhaps an underestimated and important distinction between tenants and homeowners.

“I'm not going to claim that it's very undervalued, but from the moment you could insure your building stock, you had a value that could represent something else,” he said.

“Before the 18th century, the value of housing stock was linked to what you could use it for and rent it out for then and there. But through the insurance, you had a completely different and negotiable value from private property,” he said. “The building stock was added value, not least as a subject of a mortgage loan. It was possible to sell —or mortgage — buildings, for example to run a business. The existing capital accumulation in the form of buildings could turn into mobile capital, which tenants do not have the opportunity to do.”

What about our minds?

So are we safe today? What if a bomb destroys Aker Brygge, an area in downtown Oslo full of museums, and restaurants serving upscale cuisine, for example?

“The insurance companies also offer something called reinsurance, an intricate system where an entity insures itself against excessively large liabilities. Should Aker Brygge go under, a great many insurance companies would be involved, I think,” he said.

Sogner noted, however, that it is far more difficult to insure the value embodied in modern companies, which is often said to be the minds of those who work there, called intellectual capital.

If advanced mathematics provides the basis for calculating insurance premiums for damage, house and life insurance and car collisions, that’s nothing compared to the value calculations of losing workers’ brain power.

“Look at Twitter, after Elon Musk took over. What if the employees don’t want to go along for the ride, and leave? The value of the company is largely linked to the people who work there and it is difficult to insure those heads,” he said.

But it nevertheless remains difficult to insure against bankruptcy or illness or death.

“We live in a time where we think we are insured for quite a lot. But in practice this applies only to material things. People still get sick and die, businesses go bankrupt, and people lose their jobs. There are limits to what you can insure against. The welfare state takes part of these costs. This is also a form of insurance. But material objects are still important and provide security for our values, which the state has nothing to do with,” Sogner said.

Translated by Nancy Bazilchuk

This article was updated on 3 January at 19:45 and 4 January at 10:43 to rectify a few mistakes made in the translation from Norwegian to English.

———

Read the Norwegian version of this article at forskning.no

------