The Arctic Ocean is not an important shipping route – yet

OPINION: Ten ships navigated the Northeast Passage last year, while 18,000 transited the Suez Canal. It will be a long time before the Northern Sea Route becomes an important navigational route, but the development must be followed closely.

Denne artikkelen er over ti år gammel og kan inneholde utdatert informasjon.

The century-old dream of establishing new trade routes between Europe and Asia is not about to be realised now that the sea ice has shrunk to a record-low level. In the coming years there are other powers that will propel increased shipping traffic in the Arctic.

If we do not understand what these powers are and the sorts of traffic that will come, we will be poorly prepared to prevent accidents and oil spills.

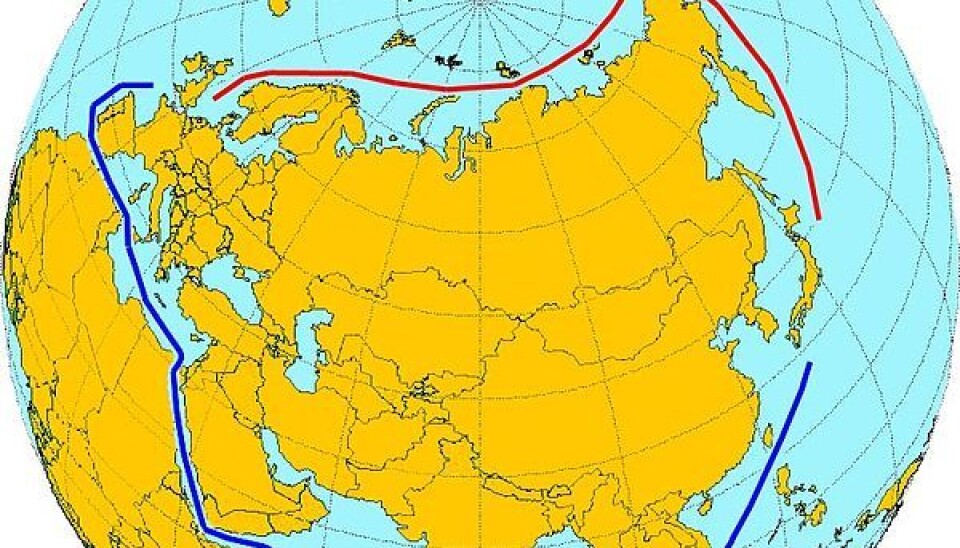

The Northern Sea Route is the section of the Northeast Passage that stretches from Novaya Zemlya to the Bering Strait. It was developed as an important part of the Soviet Union’s strategy for industrialisation in the north.

Atomic icebreakers enabled the traffic to grow until it peaked in 1987. Following the collapse of the Soviet Union, the infrastructure declined and the traffic dropped until 2005. The first ships from other countries have now begun to use the route, and the Russians want to develop an international trade route. However, the level of activity is still lower than it used to be.

Only 33 transits

There have been few recorded transits through the Northern Sea Route in recent years, but in terms of percentage there has been a large increase: four transits in 2009, five in 2010 and 33 in 2011. The cargo volume has increased sevenfold and had reached 820,000 tonnes in 2011. This can also be attributed to the fact that the ships have become larger.

Only a few of these have completed the entire Northeast Passage from the North Cape in Norway to the Bering Strait: two in 2009, one in 2010 and 10 in 2011. On the opposite side of the Arctic Ocean, north of Canada, only 26 vessels sailed the entire Northwest Passage. The majority of these were pleasure boats and virtually none were cargo ships.

In comparison, 18,000 ships transited the Suez Canal in 2011.

Even though the shipping traffic through the Arctic is growing, we are still a long way from seeing a rearrangement of the world trade route. There are few who believe this will happen in the short term. Container ships need to deliver their cargo 'just in time'. The ship owners need to be relatively assured that the ship will not hit an iceberg or an unmarked shallow in bad weather and that they will be rescued if this occurs. Further, additional costs involving reinforcement against ice, higher insurance premiums and Russian fees must not cancel out any gains achieved by shorter routes. Without profits, there will be no transit traffic.

Resources out, goods in

So why are ships navigating in the Arctic? To put it simply, they have errands there. In 2004 around half the ships were fishing vessels that were fishing in the Bering Sea, the Barents Sea and the North Atlantic. The remainder were travelling to Arctic ports to deliver goods to the local population and industry and to collect minerals, oil products, fish and other raw materials. Some ships also travel with tourists, researchers or military.

This destination traffic in and out of the Arctic Ocean is growing. Increased transport of iron ore and oil products from Northwest Russia to Asia is a clear trend.

We know that in the future increased scarcity of raw materials combined with higher prices will increase interest in a large but generally unexplored region such as the Arctic. But the costs of extracting the products and bringing them to the customer are high and this can make many of the Arctic resources too expensive.

However, there is good reason to expect resource-driven growth in the shipping traffic. The same applies to the cruise traffic.

The lack of – and the need for – data

There is currently no systematic collection of data about shipping traffic in the Arctic region and no sharing of shipping data between the countries. Data is available for some areas and vessel types, e.g. ships that transit the traffic corridor that has been established west of the North Cape.

The lack of data makes it difficult to plan search and rescue services and emergency preparedness against oil spills and other contamination. Both should be based on analyses of the risk that the shipping traffic poses. This demands data about traffic patterns, the cargo the ships are carrying and other conditions that may have an effect on the probability of accidents and the consequences should they occur.

Assessments of environmental impact and requirements for regulations will also demand better data about the traffic and the characteristics of the ships. Important relevant issues include the probability of introducing alien species, emissions in the air and discharges in the sea and conflicts with valuable nature areas.

Anticipating the development in shipping traffic is demanding. Better data about all types of transits and the cargo the ships are carrying may be used to understand which activities create which traffic. It will provide a better basis to look into the future.

Insight in present traffic makes planning possible

Researchers at Fram Centre will contribute to the gathering of data about the shipping traffic, both automatically and systematically. Larger vessels in particular must be equipped with AIS (automatic identification system) tracking equipment. This sends out electronic signals stating the ship’s position. Near the coastline these signals are tracked by land-based AIS base stations, while satellites take over when ships are further out at sea.

Up to this point data has not been stored and utilized well. Together with the Norwegian Coastal Administration, we want to continually gather AIS data and connect this with other data, to enable the required analyses.

We will then be in a better position to understand what happens in the shipping traffic and can make plans to meet the anticipated traffic growth.