How do companies and people hide money in tax havens?

ASK A RESEARCHER: Tax havens are used to avoid paying taxes. Criminals also use tax havens to hide their illegal income. But why doesn’t the international community stop this practice?

The world is home to roughly 50 tax havens, scattered across countries and states across the planet.

When most people think of tax havens, they probably think of places like the Bahamas, Bermuda, Liechtenstein and Luxembourg.

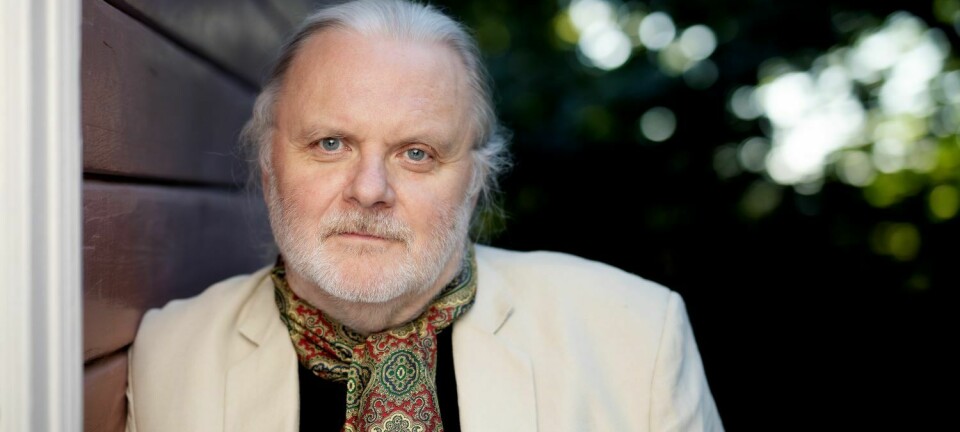

“What’s less well known is that Ireland and the Netherlands also offer tax havens. The small American state of Delaware offers perhaps the most secrecy in the world,” Professor Guttorm Schjelderup from the NHH School of Economics in Bergen said to sciencenorway.no.

Tax havens offer either low tax or zero tax for foreigners and businesses owned by foreigners. The same rules do not apply to the country's own citizens, who must pay taxes.

Tax havens are also governed by legislation that is designed to prevent the outside world from gaining access to banking or other information. This is why they work so well for criminals who want to hide their illegal earnings.

Losses in the billions

Estimates of how much countries lose each year due to tax havens range between EUR 100 and 250 billion.

The worst is that some of this money comes from developing countries, which have a desperate need for it.

A great deal has been done in recent years to tackle the issue of tax havens. The international Organisation for Economic Co-operation and Development (OECD), the International Monetary Fund (IMF) and the Tax Justice Network are working hard on the problem.

Here’s how a tax haven works

For those who want to hide money, there are several ways to make sure that their assets find their way to a tax haven with little or no tax.

Trusts are one widespread way to achieve this goal.

Trusts can be used for tax planning when a person transfers their wealth to a trust, which then can be used to benefit the same person or the person's family. If the trust is established in a tax haven, the person in question is then often no longer the legal owner of the property and is not liable to tax on the return, but will nevertheless be able to benefit from it.

The value of the trust is often managed by someone who works at a law firm in the tax haven. The trustees ensure that those who are listed in the trust receive money.

According to Schjelderup, most large multinational companies in the world have what is called a holding company in a tax haven. These holding companies own companies in other countries.

“Dividends from companies in normal states are sent to the holding company in the tax haven,” he said.

Paying for the name IKEA

“A widely used solution for moving profits from ordinary states to holding companies in tax havens is to let the company in the tax haven own important patents or a brand name, such as IKEA,” he said.

Patents and brand names are difficult to place a value on. That means there’s a lot of leeway when payments are determined. This is how a lot of profits are transferred to tax havens.

The holding company thus becomes a piggy bank for shareholders and is used for global tax planning by multinational companies such as Apple, Starbucks and Google.

Some defenders of tax havens argue that they have value because they can prevent double taxation, or paying tax on the same income in two countries. Schjelderup discusses this in an article in the national newspaper VG here (in Norwegian).

The purpose is to hide information

“People now criticize tax havens as much for their lack of transparency as their ability to facilitate tax evasion,” Schjelderup says.

“Tax havens offer secrecy. For example, a tax haven makes it impossible to determine who the owners of a company are. And if you are anonymous, you can easily do things that you’d otherwise never do if you were in the public eye,” he said.

Schjelderup points out that three American economists received the Nobel Prize in Economics in 2001 for showing that this kind of lack of information or hidden information weakens the world economy.

Much of the purpose of tax havens is to hide information. You might reasonably think that society could have eliminated tax havens a long time ago.

“But this hasn’t happened, because the economic elite in the most powerful countries in the world have an interest in the services tax havens offer,” Schjelderup said.

Who owned the Scandinavian Star?

The NHH professor also thinks it’s concerning how responsibility disappears when a company is located in a tax haven. As an example, he cites the case of the Scandinavian Star, a ferry that operated between Oslo and Fredrikshavn, Denmark. In April 1990, a fire set by an arsonist killed 159 people.

“We still don’t know who owned the Scandinavian Star. The ship’s ownership was hidden in a tax haven,” he said.

“In a tax haven, the company register often contains no other information than the company's name and the nominal value per share. What is often left out or hidden is the identity of the company’s real owner,” Schjelderup said.

“The requirements in some countries, such as Panama, that the people who are on the company board must have a presence in the country are addressed through the use of straw men,” he said.

Tax havens also make it easier to be a criminal. Everything from violations of national and international regulations, to corruption, money laundering and tax evasion are made easier by the existence of these highly secretive states.

Some tax havens have adopted strict rules on paper as a way to evade international scrutiny, but then fail to enforce those rules.

More being done to increase transparency

Schjelderup says that more is now being done to increase transparency related to companies in tax havens. But so far the focus has been on taxes and less on other secrecy issues.

“More and more countries have entered into agreements that allow automatic information exchange related to taxes. In the USA, companies that don’t comply with these regulations can be subject to high tax penalties,” he said.

In recent years, the OECD in particular has worked to demand that tax havens enter into agreements on the exchange of information with other countries. Most tax havens have now agreed to do this. These agreements give the tax authorities in countries such as Norway, for example, access to information about Norwegian taxpayers' income and wealth in the tax haven.

At the same time, it’s still a bit of a cat and mouse game, Schjelderup said.

The lack of public registers similar to the Norwegian Brønnøysund Register and shareholder registers makes it very difficult in practice to find out who really owns companies that are registered in tax havens.

Poor countries are most harmed

Both rich and poor countries are harmed by the existence of tax havens. But the detrimental effect seems to be greatest for poor developing countries, Schjelderup concludes in this article about tax havens.

The Norwegian Capital Flight Committee (NOU 2009: 19) documented that leaders in poor countries have stolen huge sums from the community and hidden them in tax havens.

This is money that could have been used for schools, health care and other infrastructure.

“Poor countries do not have the same resources as rich countries to fight this type of crime, and tax havens give people who steal from the community a place to hide it,” Schjelderup says.

Translated by Nancy Bazilchuk

Read the Norwegian version of this article on forskning.no.

Reference:

Guttorm Schjelderup: “Secrecy jurisdictions”, Int Tax Public Finance, March 2015.